Net zero strategies of top European speciality chemical companies

Dr Michelle Lynch • July 22, 2021

CCD Partners Senior Advisor Dr Michelle Lynch

analyses the net zero roadmaps of five of Europe's leading speciality chemical companies, exploring the details of their strategies and evaluating the real-world impact of their commitments to climate neutrality.

Decarbonisation Strategies

Europe has committed to being the first climate neutral continent

in the world by 2050.

This means that in less than 30 years’ time, the majority of chemical products will not be made from fossil fuels. Considering that it has taken over a century to build and grow a fossil fuel economy, transitioning to renewables in the given timeframe for NetZero is a major challenge for the chemical industry. Many large multinational chemicals and industrial corporations have already disclosed their NetZero roadmaps, plans and strategies and in this article we look at what those are and how they compare.

First of all, it is important to understand which NetZero toolkits are available to the chemical industry in order to remove fossil fuels from its supply chain. For NetZero to have the desired impact on meeting the climate neutral goals, the entire value chain must be decarbonized. Therefore, the industry is looking to switch to low carbon feedstocks, energy efficient chemical or biochemical transformations, renewable utilities for the manufacturing processes and carbon-neutral transport for delivery of feedstocks and intermediates, as well as final products to the customer. This article focuses on the chemical feedstocks and transformations.

Four main approaches are available:

- Use of biobased feedstocks and fermentations

- Use of recycled waste e.g. plastics, rubber, textiles and food

- Indirect electrification of chemical processes

- Use of waste carbon dioxide and green hydrogen (CCU/PtX)

Carbon capture and storage (CCS) has not been included in the above list, because it does not decouple chemicals production from fossil fuels and it is not a circular economy approach. It will be required as a negative emissions technology (NET) however this is outside the scope of this article.

In order to completely decouple from fossil fuel production, all organic chemicals will need to be made from green hydrogen produced via water electrolysis and carbon dioxide captured from flue gas streams and, further along, from the air (direct air capture – DAC). This toolkit is referred to as “Power-To-X” because it takes the energy from electrical power and transfers it into one or more organic chemicals, energy carriers and fuels. Combining PtX with carbon dioxide capture and utilisation (CCU) is a powerful method for decarbonisation. It is envisaged that in future, as renewable electricity costs are reduced and electrolysers meet their key performance targets, PtX will be a viable route compared with traditional fossil fuel technologies. The transition to PtX as the main tool for chemicals production is forecast to accelerate after 2030 when electrolysis is operating at multi-GW scale and carbon capture technology is economic at a suitable scale for CCU.

The use of biobased feedstocks has been growing for the last two decades, and many fossil based plastics can be replaced either with a direct drop-in, e.g. bio-PET or a biobased alternative e.g. polylactic acid (PLA) or polyhydroxyalkanoate (PHA). The use of recycled waste has become much more prevalent – plastics and rubbers can be recycled either mechanically to make new plastic bags for instance, or chemically to make a pyrolysis oil which can then be used to make fresh monomers e.g. ethylene and propylene. Textiles and food can also be chemically recycled and many olefins producers are trialling the use of pyrolysis oil derived from a mixture of waste products. In order to mitigate the production of long-lasting plastic waste, companies have produced biodegradable products, and some of these are made from biobased feedstocks.

Calculating the carbon footprint of both waste and bio-derived goods is not straightforward, and the wider lifecycle impacts also need to be considered to ensure that there is not more harm overall being caused to the environment e.g. due to deforestation or soil erosion. The social impacts also need to be considered. These factors and others form the basis of the 17 United Nations Sustainable Development Goals (SDG) as shown in Figure 1 below. The challenge for chemical producers is to ensure that their pathways to NetZero also align with the UN SDG and at this stage, many companies are looking at how to manage the task of collecting lifecycle assessment (LCA) data across many hundreds and thousands of chemical products in their portfolios. Then once they have this data, they will be in a more informed position to decide on the best methods to remove fossil fuels from their supply chains. The remainder of this article looks at the NetZero strategies of five key speciality chemicals companies who have announced their NetZero and decarbonisation plans.

Figure 1. The United Nations Sustainable Development Goals

Company-level Plans

BASF

BASF, headquartered in Ludwishafen, Germany has announced its path to climate neutrality with an overall target of NetZero by 2050 and an interim target for 25% tCO2eq reduction by 2030 using the 21.9 million tCO2eq emissions in 2018 as a baseline. The company plans to invest up to €4 billion over this decade in support of its carbon reduction plans. Over €1 billion of these funds are earmarked for 2021-2025. BASF has an extensive internal library of lifecycle data on its products which it can leverage to make decisions about which pathways to employ for NetZero. Key technologies which will help to meet its initial targets include: electrically heated steam crackers for production of olefins, and electrical heat pumps for producing carbon neutral steam. Other projects include development of methane pyrolysis technologies for production of hydrogen – if utilized with biogas/biomethane these can be fossil free. Other areas of development include carbon capture, utilisation and storage (CCUS) and use of proton exchange membrane electrolysis (PEMEL) to produce green hydrogen. (Nonnast, 2021) BASF also has technology for a number of biobased chemicals and plastics and uses its “biomass balance” approach which incorporates biogas and bio-naphtha (produced from bio-pyrolysis oil) as feedstocks for its chemicals production. (BASF, 2021).

Croda

Croda, headquartered in Snaith, Yorkshire, UK has had a set of sustainability goals in place since 2015 which ran until 2020 with longer-term targets for 2030. The long term goals are split amongst there areas. (Croda, 2020):

- Climate Positive: Croda’s Carbon Cover strategy aims by 2030 to sell products which save four times as much carbon associated with its business. In addition it has set out Science Based Targets (SBT) to limit its emissions e.g. through use of renewable energy in its processes in line with limiting the global temperature rise to 1.5ºC above pre-industrial levels. The company has pledged to move its organic feedstocks to 75% biobased c.f. 63% in 2019.

- Land Positive: Croda’s crop protection ingredients, seed treatments and new technologies will save more land than is used to produce them; by 2030 two technological breakthroughs for crops per year which mitigate climate change and land degradation and formation of three partnerships that contribute to tackling compromised farmland.

- People Positive: goals pertaining to vaccine development, UV protection skin products, gender balance within the organisation and establishment of the Croda Foundation to help the local communities.

Croda uses a number of methods to track its progress and has received awards and high sustainability ratings from external organisations and awards bodies.

Evonik

Evonik, headquartered in Essen, Germany has announced its 2020+ strategy covering climate, water and portfolio management. The strategy sets out to make continuous improvements to the sustainability of its manufacturing processes and to meet customer demand for renewable products. Specific near-term goals are to halve Evonik’s GHG emissions by 2025 compared to a 2008 baseline. It will use internal CO2 pricing to assist with sustainable investment decisions. For water, Evonik is introducing a worldwide water management system with specific plans to avoid water stress.

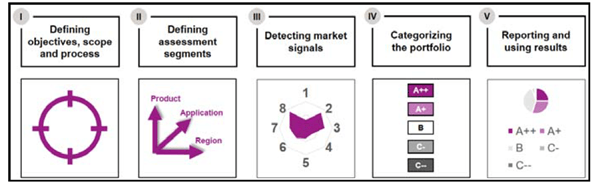

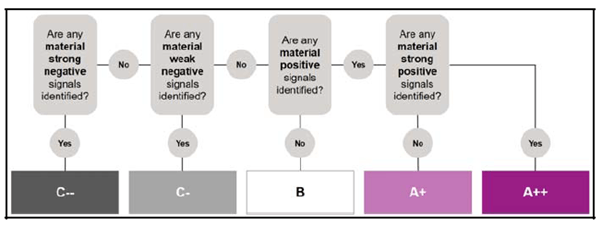

Evonik employs its Sustainability Analysis 2.0 methodology to monitor performance and supplement its other strategic business analyses. This uses the product-application-region-combinations (PARCs) approach for portfolio standard assessment (PSA) as shown in Figure 2 below.

The eight market signal categories are:

- Chemical hazard and exposure across the life cycle

- Anticipated regulatory trends

- Sustainability ambitions along the value chain

- Authoritative ecolabels, sustainability-related certification, and standards

- Environmental and social performance across the life cycle compared to alternative solutions

- Sustainable value creation

- Contribution to the UN Sustainable Development Goals

- Contribution to the company's internal guidelines and objectives

The results of the PARCs analysis are used in Evonik’s annual reporting and external communications. It reports that 90% of its products and solutions have sustainability performances at least in line with the market reference (leader, driver, or performer category). Its goal is for 35% in the leader and driver categories i.e. above, or well above, market reference.

Products in these categories form part of Evonik’s Next Generation Solutions. LCAs will also be used for more product-oriented measures to reduce the company’s carbon footprint and water management.

Figure 2. Portfolio Standard Assessment (PSA) Framework and Rating System (Evonik, 2019)

Evonik has a range of biorenewable products including bioplastics and bio-surfactants and is working on circular plastics from pyrolysis oil. It is also working on artificial photosynthesis which combines water electrolysis and fermentation of biobased feedstocks to produce renewable chemicals. It has also begun developing membranes for a new type of water electrolysis technology called anion exchange membrane (AEM) as part of the EU CHANNEL project. AEM is an interesting development because it overcomes the issues of large precious metal requirements for PEMEL and use of caustic liquids for alkaline electrolysis (AEL).

Solvay

Solvay, headquartered in Brussels, Belgium has introduced its Solvay One Planet initiative which is structured around three pillars:

- Climate:

- Lowering GHG emissions by 26% in line with keeping well below a 2°C temperature increase. Using renewable energy, energy efficiency, an internal carbon price €50/ tCO2eq in all investment decisions and use of circular economy approaches. Current emissions at Solvay are 10.1 million tCO2eq.

- Eliminating coal – Solvay will not engage in building coal fired power plants by 2030 and will look for renewable alternatives where resources exist.

- Reducing its pressure on biodiversity by 30% including terrestrial acidification, water eutrophication and marine ecotoxicity.

- Measuring climate impact of its production and services in conjunction with customers.

- Resources

- Increasing water use efficiency to reduce intake of freshwater by 25%.

- Accelerating the circular economy in partnership with the Ellen McArthur.

- Foundation with goals: 15% of product sales from renewable and recycled product sales and reduce industrial waste by 33%.

- Collaboration with Solar Impulse Foundation to increase sustainable solutions to 65% of total group sales. Methods include research and innovation, M&A, strategy and impact quantification.

- Better life

- Prioritising safety, embedding diversity, equity and inclusion, extending maternity and paternity leave.

The One Planet initiative focuses on areas where its products and solutions have maximum impact and alignment with the UN SDGs. The initiative is implemented using Solvay’s Purpose and G.R.O.W (Growth, Resilient Cash, Optimize, Win) strategies and the actions and projects undertaken are measured against ten key SDG. In 2020, Solvay boosted its sustainability plans with the introduction of science based targets (SBT).

Specific low carbon technologies include: use of biogas energy, chemical recycling of plastics, production of lithium ion battery (LIB) materials, battery recycling, sustainable tire materials, lightweight aircraft parts, clean air and water solutions and crop growth biostimulants. (Kadri, 2020)

Unilever

Unilever, headquartered in London, UK, has pledged to reach NetZero carbon emissions from its products up to the point of sale, by 2039 and to halve the GHG impact of its products across the lifecycle by 2030. €1 billion in investment will be placed into the Unilever Climate & Nature Fund over the next ten years. Internally, the goal is to achieve zero emissions in Unilever’s operations by 2030. While the focus is on innovation, part of its strategy will be to generate or purchase high-quality GHG offsets for any residual emissions. Unilever pledges to share the carbon footprint of its products with customers by 2030.

Each division has its own strategy for reducing GHG:

- Home Care: The ‘Clean Future’ programme seeks to have fossil-free cleaning and laundry products by 2030, using “rainbow carbon” i.e. plants (green carbon), atmosphere (purple carbon), marine algae (blue carbon), and waste plastic (grey carbon). €1 billion will be invested to meet this goal. to Further measures include more concentrated detergents which require less water weight to be shipped and use smaller bottles.

- Foods & Refreshment: Future Foods strategy, which aims to achieve €1 billion in sales from plant-based meat and dairy alternatives. In addition, the aim is to halve food waste in direct global operations by 2025.

- Beauty & Personal Care: Reach 1 billion people per year by 2030 with products that improve health and wellbeing and advance equity and inclusion.

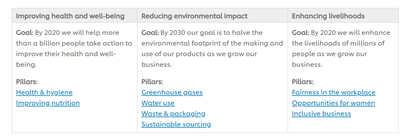

The NetZero aims are administered through the Unilever Sustainable Living Plan (USLP) which was launched in 2010 and provides an all-encompassing blueprint achieving sustainable growth across Unilevers’ brands and business divisions globally. The ULSP has three main goals and nine pillars as shown in Figure 3. These are audited every two years using a materiality analysis.

Figure 3. Unilever’s Sustainable Living Plan Goals and Pillars (Unilever, 2021)

Specific low carbon products include paper-based detergent bottles with a proprietary internal hydrophobic coating, refillable deodorants and mycoprotein for plant-based foods.

Closing Remarks

Achieving net zero in the given timeframe requires access to an extensive toolkit of decarbonisation technologies and many billions in investment. A diversity of approaches is required, and each needs careful and effective lifecycle calculations to ensure the best chance of being effective.

It is true to say that not all decarbonisation methods were created equal. Biobased approaches can suffer from unintended consequences on land and water use and as seen with products such as palm oil, deforestation in order to use land to profit from crops. The switch from plastic to paper and other biodegradable materials needs to be carefully considered as this perpetuates a single-use culture. Many plastic items can be utilized repeatedly and chemically recycled into new plastic products. Reuse in general has a much higher positive environmental impact than materials which are designed for single use.

Negative action goals such as agreeing to cease a polluting activity at a future date are often criticized and may not be enough to appease activist investors and shareholders looking to green their portfolios. Some goals and internal processes such as setting of “science-based targets” might also be seen a repackaging of the business as usual unless there are distinct new feedstocks and processes being introduced into the business.

In contrast more proactive goals which look to reduce and utilize waste offer a dual benefit, reducing the environmental burden of land and ocean waste while displacing the need for virgin resource extraction. Waste pyrolysis, biogas utilisation and CCUS approaches are all valuable methods which fall into this category.

Dr Michelle Lynch

offers consulting projects exclusively aimed at reducing the ecological footprint of chemicals, fuels, energy and power systems across their full lifecycles.

She offers support to start-ups, SME’s, investors, multinational companies, government funding arms, and universities. Michelle runs her business out of London, UK and is passionate about helping technology developers to realise the goal of NetZero via high impact sustainable technology solutions.

CCD Partners is a consultancy specialised in corporate transformations in small and mid-market chemicals and life sciences businesses.

To organise a call with one of our partners please email contact@ccdpartners.com

Receive M&A news relevant to your business

At critical moments our clients engage us to provide pre-publicity "off-market" intelligence to give them the edge over the competition - we also provide up-to-the-minute public or "on-market" intelligence for free

Contact Us

RECENT POSTS

In the latest episode of the Chemical Transformations podcast , CCD Partners' Managing Partner Matt Dixon speaks with Ted Clark, former President and CEO of Royal Adhesives & Sealants, discussing his new book "Shipping Clerk to CEO: The Power of Curiosity, Will, and Self Directed Learning”. The book tells the story of Clark’s remarkable career journey from entry-level worker to CEO of a $240m chemical company by the age of 42.

Biosynth Carbosynth is a fully hybrid Research Products, Life Sciences Reagents and Custom Synthesis and Manufacturing Services Company with global research, manufacturing and distribution facilities. They are the supplier of choice for many in the pharmaceutical, life science, food, agrochemical, cosmetic and diagnostic sectors and manufacture and source a vast range of chemical and biochemical products.

Steve Allin co-founded Charnwood Molecular with Phil Page in 1998. 22 years later, the business has evolved dramatically from its origins as a spinout of Loughborough University. Backed by a partnership with Synova Capital, the company is now preparing to move into a former AstraZeneca research facility and has already completed its first M&A deal, acquiring Aurelia Bioscience in summer 2021. CCD Partners’ Matt Dixon spoke with Steve about the journey from full-time academia to running a high-growth market leader.