M&A pipeline

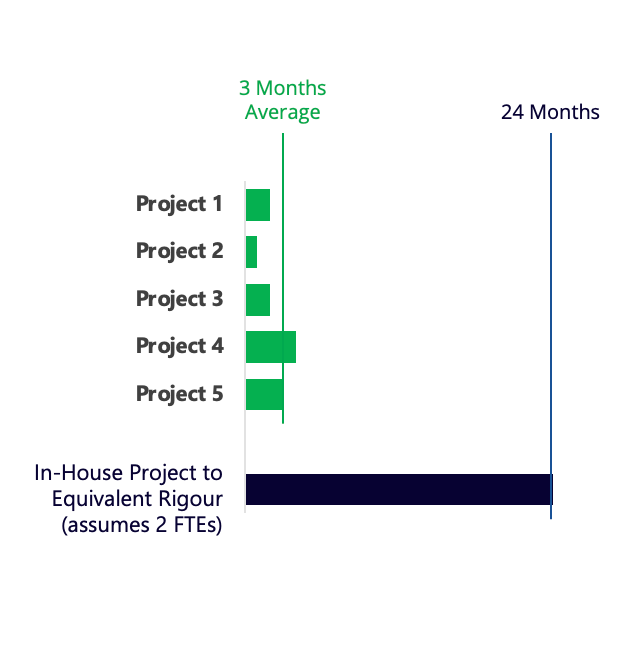

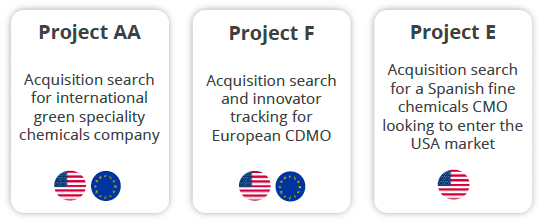

Our M&A pipelines are built on decades of deep industry relationships - giving us direct access to the decision-makers who matter. This unmatched connectivity allows us to source high-quality opportunities faster and with greater precision

Unlocking Transformative Outcomes in Niche Markets

We help clients capture the full potential of high-stakes transactions. By combining deep market insight, specialist expertise, and strategic precision, we guide businesses toward high-growth, high-impact outcomes—avoiding the pitfalls that lead to underperformance or failure.

We are delighted with the deal and with the CCD Partners team [… they were] instrumental in realising this potential for us and, for anyone considering a similar transition process, I cannot recommend them enough.

Phil Page

Founder, Charnwood Molecular