Divestments

Specialist M&A advisory for chemicals and life sciences. We guide critical transactions with deep sector expertise

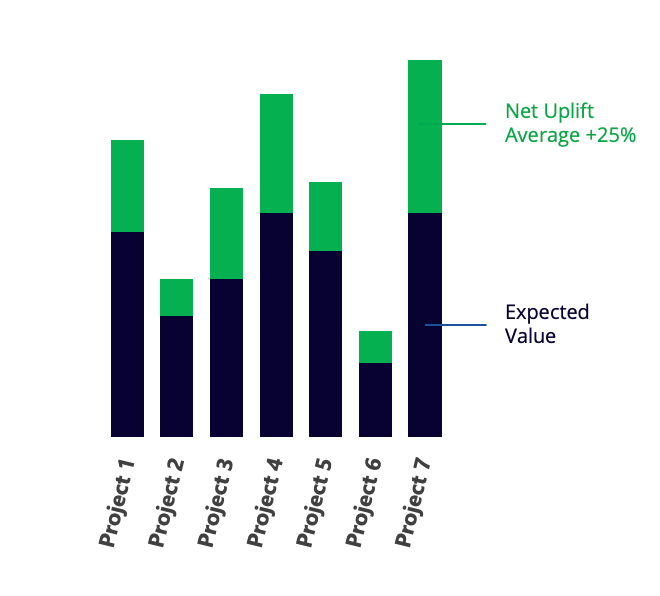

We aim to secure maximum deal value for our divestments

We consistently exceed expectations by combining deep sector knowledge with rigorous buyer targeting, operational benchmarking, and strategic positioning. Our tailored divestment processes deliver an average 25% uplift above initial value estimates, ensuring our clients realise the full worth of their businesses.

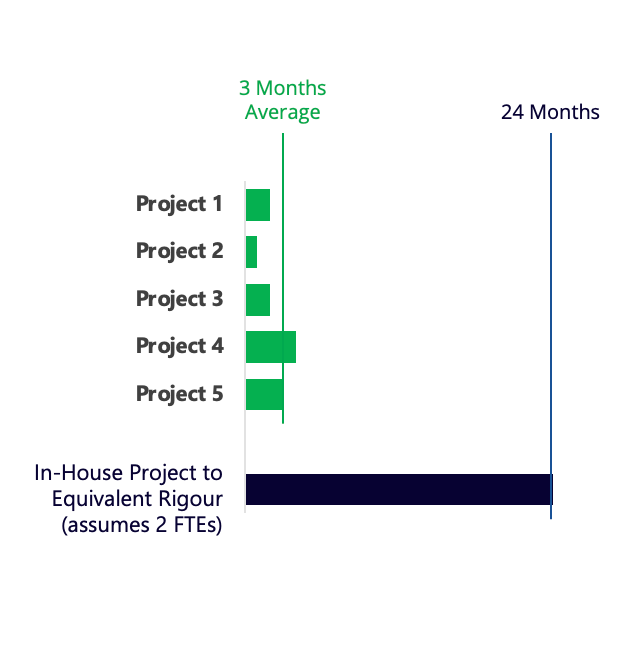

M&A pipelines

launched in 3 months

Through a structured, data-led approach, we build high-quality M&A pipelines in a fraction of the time. By combining proprietary intelligence with sector-specialist execution, we deliver results in 3 months vs the industry standard of 2+ years.