Covid-19 Pandemic and Post-Merger-Integration – Communication makes the difference

Andre Schommer • January 28, 2021

Why structured and regular communication is the key to both COVID-19 and M&A success

COVID-19 has created many challenges for businesses in the last year. These challenges can have positive and negative outcomes depending on how they are handled. Similarly, M&As can also have positive and negative outcomes depending on how they are handled.

A critical success factor for both is corporate communication. Andre Schommer, Partner and head of CCD Partners' post-merger-integration (PMI) arm draws out the parallels.

Destroying and creating value through M&A

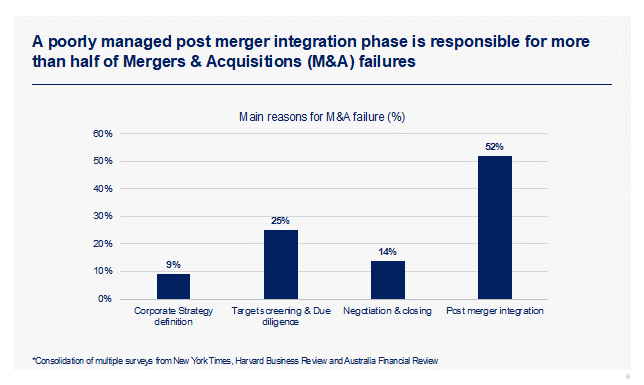

One of the most common factors in M&A failure (i.e. failing to create value or even to destroy it) is insufficient focus on the PMI phase.

With ambitious growth plans to follow, CEOs and senior managers risk losing focus once a deal is completed (and a subsequent share price spike is generated) and may move rapidly on to preparing for the next acquisition, instead of supporting their integration teams to fully deliver all synergies.

The fundamental importance of the PMI phase stems from a range of factors.

Chief among these is the varying impact that the announcement of a merger or acquisition has on different stakeholder groups:

- Employees of the acquiree are typically concerned with job stability and looking to management for details around the organizational structure of the new entity.

- Employees of the acquiror are less likely to feel unsettled, but will be keen for an understanding of the deal drivers, opportunity created, and long-term company vision.

- Customers of both businesses will want confirmation of how contractual obligations and account support will be handled, with similar questions raised by partners and suppliers.

- Investors in the acquiror will be looking for details around projected shareholder returns, with a particular focus on the underlying deal rationale and forecast timeframes for realization of upside.

Successfully handling this range of stakeholders requires a clearly defined communication strategy – one that provides a framework for each manager, team, and leadership group to effectively communicate with related parties quickly and responsively, despite the inevitably shifting parameters of a complex initiative.

Interestingly for business leaders, this blueprint for cross-factor communications during a time of rapid change has many important parallels with government and corporate communications throughout the coronavirus pandemic.

What we can learn from COVID communications

In a daily press conference from 2nd April 2020, Canadian Prime Minister Justin Trudeau stated “we’ve learned a lot from South Korea, Singapore, and other countries. We’ve learned unfortunately a lot from Italy as well, in terms of what worked and what didn’t work there.”

Based on the template built by South Korea, Canadians could take notes on creating a rapid-response epidemic control system that integrates communications.

That wasn’t always the case - during the 2015 Middle East Respiratory Syndrome (MERS) outbreak, South Korea’s lacklustre response and unclear communications fostered anxiety among the public.

However, the system was reformed - South Korea’s Centre for Disease Control now houses an Office of Communication, specifically designed to prevent misinformation and control the flow of certified data for decision-making and broadcasting.

During COVID-19, communications were effective and efficient because key channels of distribution (for instance, an emergency text message system) were already in place, established in anticipation of similar high-pressure scenarios.

Since 2016, this Office of Communication has recruited members of the general public to assess and guide its messaging strategies. South Korean compliance with public health guidelines in 2020 is far greater than it was during MERS, demonstrating that institutionalization can also expand capacity to measure, understand, and respond to public sentiment during a pandemic, including on social media.

Around the world, similar patterns have been observed – governments, scientists, and healthcare services have succeeded or failed to varying degrees not purely as a result of their decision-making, but based on their ability to rapidly communicate complex initiatives under time pressure, and to a wide range of stakeholder groups.

Capturing Hearts & Minds

However, infrastructure and process alone are not enough.

Even the most efficient messaging system is ineffective if the recipient is not emotionally committed to engaging with the instructions or advice being issued.

Once more, this has been evidenced widely throughout the pandemic, with populations’ faith in their governments and media significantly impacting their willingness to comply with recommendations or restrictions.

The parallel with PMI scenarios continues here too, with any communication strategies fundamentally dependent on the underlying engagement of the stakeholder groups in question.

One of my mentors, Daniel Hughes, once told me to never underestimate the importance of capturing people’s “hearts and minds” before any strategic initiative. It is my firm belief that capturing hearts and minds is crucial to successful PMI, as well as for pandemic-related crisis management.

Key to capturing hearts and minds is the ability to use communication structures to listen, understand, and deliver information effectively so that you can build trust and stability. Trust and stability counteract the uncertainty and anxiety created by major changes.

Communications strategies which are built around top-down unidirectional directives often fail in this regard, and avoiding this trap was a key component of success in my career when delivering Elementis's successful acquisiton and integration of Summit Reheis.

Key Takeaways

Designing and implementing effective communication strategies is a vital aspect of fully capturing the value potential of a merger or acquisition.

Government leadership and business share the same core aims:

- Tailor the approach to clearly-defined stakeholder groups

- Enable rapid two-way information flow

- Build trust and stability to win hearts and minds

Andre Schommer is Head of Strategic Consulting at CCD Partners.

CCD Partners is a consultancy specialised in corporate transformations in small and mid-market chemicals and life sciences businesses.

To organise a call with one of our partners please email contact@ccdpartners.com

Receive M&A news relevant to your business

At critical moments our clients engage us to provide pre-publicity "off-market" intelligence to give them the edge over the competition - we also provide up-to-the-minute public or "on-market" intelligence for free

Contact Us

RECENT POSTS

In the latest episode of the Chemical Transformations podcast , CCD Partners' Managing Partner Matt Dixon speaks with Ted Clark, former President and CEO of Royal Adhesives & Sealants, discussing his new book "Shipping Clerk to CEO: The Power of Curiosity, Will, and Self Directed Learning”. The book tells the story of Clark’s remarkable career journey from entry-level worker to CEO of a $240m chemical company by the age of 42.

Biosynth Carbosynth is a fully hybrid Research Products, Life Sciences Reagents and Custom Synthesis and Manufacturing Services Company with global research, manufacturing and distribution facilities. They are the supplier of choice for many in the pharmaceutical, life science, food, agrochemical, cosmetic and diagnostic sectors and manufacture and source a vast range of chemical and biochemical products.

Steve Allin co-founded Charnwood Molecular with Phil Page in 1998. 22 years later, the business has evolved dramatically from its origins as a spinout of Loughborough University. Backed by a partnership with Synova Capital, the company is now preparing to move into a former AstraZeneca research facility and has already completed its first M&A deal, acquiring Aurelia Bioscience in summer 2021. CCD Partners’ Matt Dixon spoke with Steve about the journey from full-time academia to running a high-growth market leader.